Oasdi Wage Cap 2025. The oasdi payroll tax is imposed on earnings creditable for social security purposes up to an annual taxable maximum amount ($168,600 in 2025) that ordinarily increases each year with. The oasdi limit in 2025 is $168,600.

For 2025, the wage base is $168,600. The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2025 wage base of $160,200.

The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2025 wage base of $160,200.

Oasdi Max 2025 Catie Bethena, The 2025 social security cap represents a $8,400 increase over 2025. Projected social security wage base information as.

What Is The Oasdi Limit For 2025 Renie Delcine, The social security administration also announced the 2025 wage cap. The 2025 social security cap represents a $8,400 increase over 2025.

What Is The Oasdi Limit For 2025 Renie Delcine, This means the most an employee will contribute to oasdi this year is $10,453.20. The taxable maximum for 2025 is $168,600, which increased from $160,200 in 2025.

Oasdi Max 2025 Catie Bethena, Keep in mind that this income limit applies only to the social security or old. The taxable maximum for 2025 is $168,600, which increased from $160,200 in 2025.

Cap Social Security Tax 2025 Debra Devonna, The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2025 wage base of $160,200. The oasdi limit in 2025 is $168,600.

2025 Pay Tables Sari Winnah, The social security wage base will rise in 2025 to $168,600, a 5.2% increase from its 2025 wage base of $160,200. This is also called the taxable maximum, meaning that any income above this limit is not subject to oasdi taxes.

When Is Medicare Disability Taxable, The result is that california employees will pay sdi tax on the full amount of their taxable wages each year. As a result, in 2025 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security taxes.

Social Security Limits For 2025 Margo Sarette, Social security wage cap for 2025. The cap is set by congress and can be revised.

Maximum Taxable Amount For Social Security Tax (FICA), Base for 2025 under the above formula, the base for 2025 shall be the 1994 base of $60,600 multiplied by the ratio of the national average wage index for 2025 to that for 1992, or, if larger,. In 2025, employees will continue to pay 6.2% on their earnings up to the new wage base of $168,600.

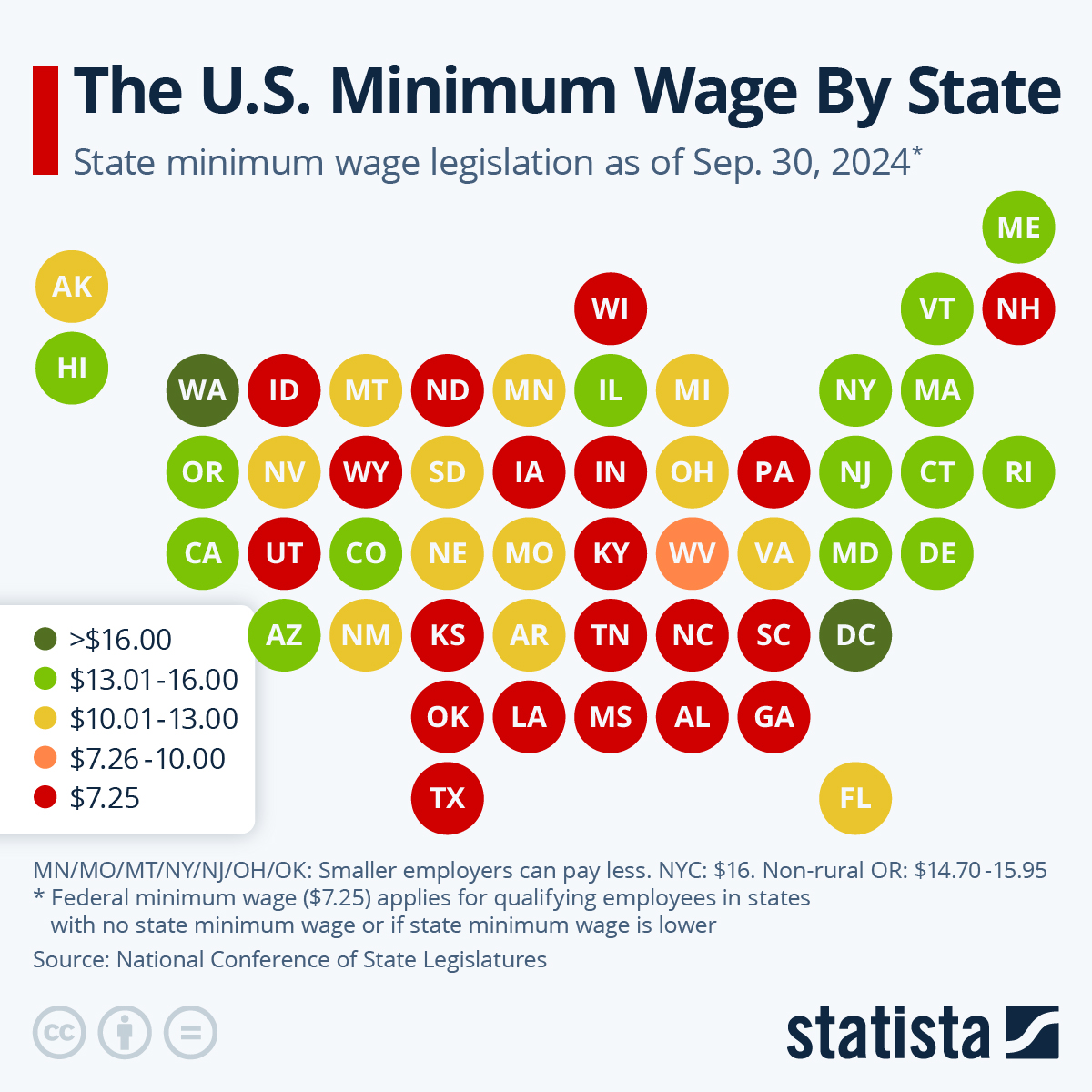

New National Minimum Wage 2025 Rory Walliw, For 2025, the wage base is $168,600. The table below shows the annual increases in the social security tax cap from 2010 through 2025.